You are reading Week 19 of 52 Weeks to Eliminate Debt & Curb Spending. Please read the overview here to learn more about the series & get your FREE financial planner. If you just joined us, please start with week 1.

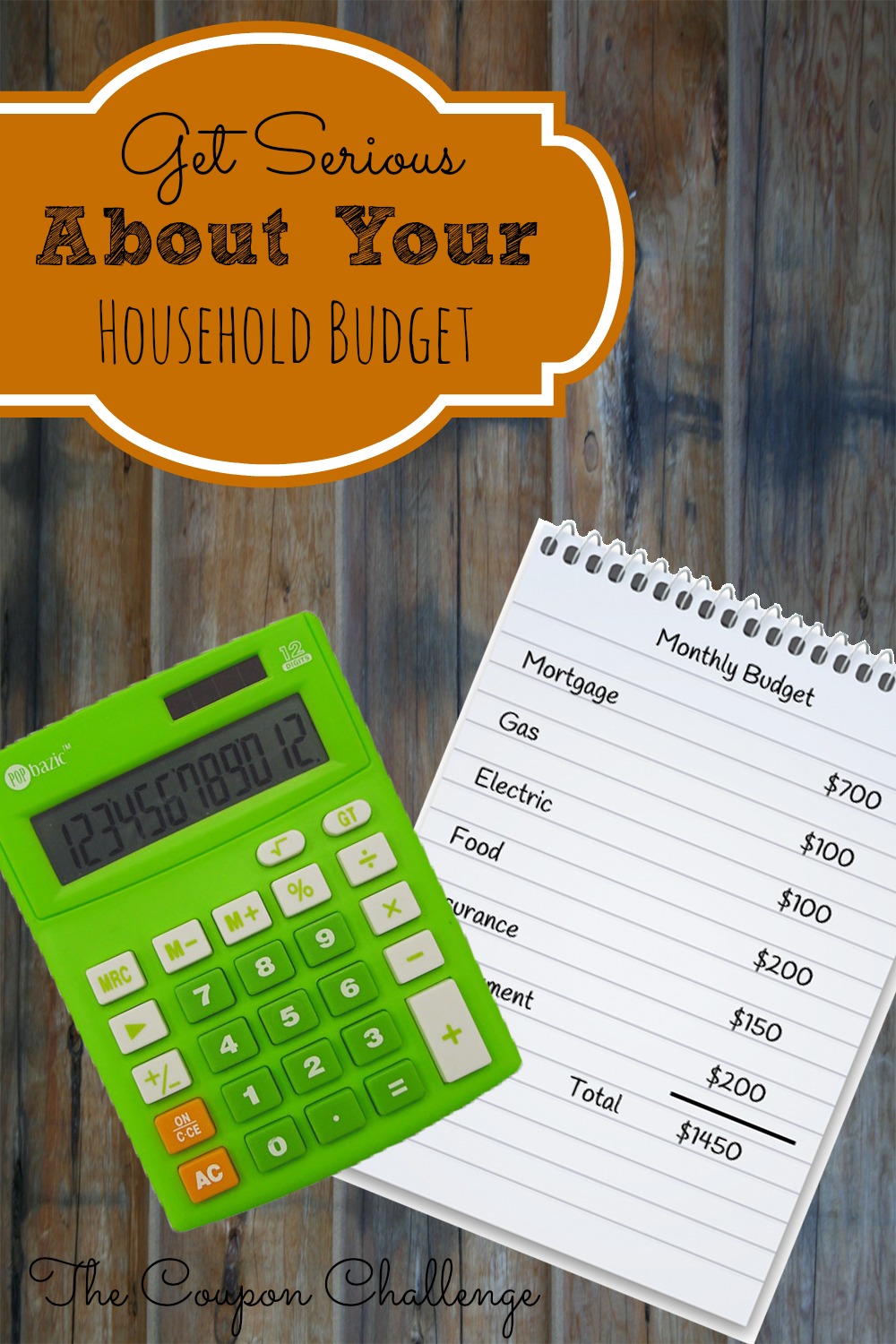

We have covered a lot of topics so far this year regarding getting rid of debt, and that included our starting posts that told you how to make a functional budget. This week we are pausing to look back and get serious about your household budget. It’s time to look at some drastic ways to reduce your expenses, so you can pay more toward your debt or save.

Cut back your grocery budget. You can’t cut out your grocery budget, but you can change it drastically. Coupons are free and easy to use to help lower your budget. Various savings and cash back apps for your smart phone are excellent choices as well toward lowering your grocery costs. Cutting back on meats, alcohol and junk foods are other ways you can lower what you are spending. Using menu plans and even freezer meals can stretch that budget even farther and help you to find wiggle room to apply toward your debt.

There are tons of posts to help you get started already on my site. I have a series on how to save money at your favorite stores which may help reduce your grocery expenses. If you’re not interested in coupons, take a look at my frugal living articles to help you live well on less.

Eliminate your entertainment budget. This one hurts, but it is necessary. Switch from the weekly entertainment budget to finding free things to do with your family or spouse. Watch movies at home on your streaming service like Netflix or Amazon Prime.

Play board games, or watch a prime time TV show together. Go for walks, visit free art galleries or take in local free musical performances. Halt eating out in favor of making meals together. Eliminate this extra item in your budget and easily free up $100-$200 a month.

If you live in Hampton Roads, I share a weekly round-up of free weekend activities. You can also search for a blog with local events in your area to stay busy for less.

Lower your utility costs. We are spoiled. Yes, that is brutal and may not apply to everyone, but reality is we have become accustomed to the comforts of cool houses and hundreds of TV channels.

Things like changing the temperature on your thermostat, using ceiling fans and avoiding use of the oven in the summer can keep your home cooler.

Throw on extra layers, use wood heat and invest in proper insulation of your windows and doors in the winter. These simple tricks can be the difference between saving or spending hundreds of dollars each year.

It is time to get serious about your household budget, and focus on really seeing your expenses and spending habits for what they are. When you are struggling to pay the minimum balances you sometimes have to adjust your life to reflect the need for more income. To get rid of debt you must make sacrifices. This doesn’t require a diet of beans and rice, but does mean you will need to focus on what is important versus what feels good and is convenient.

Week 19 Challenge:

What expenses can you cut or reduce to lower your monthly expenses? Jot down ideas on ways to seriously cut the extra expenses from your budget. Add up the amount and post it somewhere you will see it daily. Every time you want to lower the thermostat this summer, think about how much additional money you are paying toward your debt and how good it will feel to finally be debt free.

Disclosure: I am not a financial adviser nor do I have formal financial training. All articles are for informational purposes only and should not be interpreted as financial advice or consultation. Please consult your account and/or financial adviser before making changes to your finances. All situations are different, so please consult a professional to determine your individual needs.

[…] 17: Why Do You Need a Savings Account? Week 18: How to Find & Eliminate Hidden Fees Week 19: Get Serious About Your Household Budget Week 20 Week 21: Week […]