You are reading Week 2 of 52 Weeks to Eliminate Debt & Curb Spending. Please read the overview here to learn more about the series & get your FREE financial planner. If you just joined us, please start with week 1.

Once you have set up your debt relief goals, it is time to look at your budget and determine how to make those goals happen. This week we will help you learn how to Make A Functional Family Budget. Budgets do not have to be a dreaded thing, nor restrictive. They are just simply a guideline to help you to stay on track and not over spend.

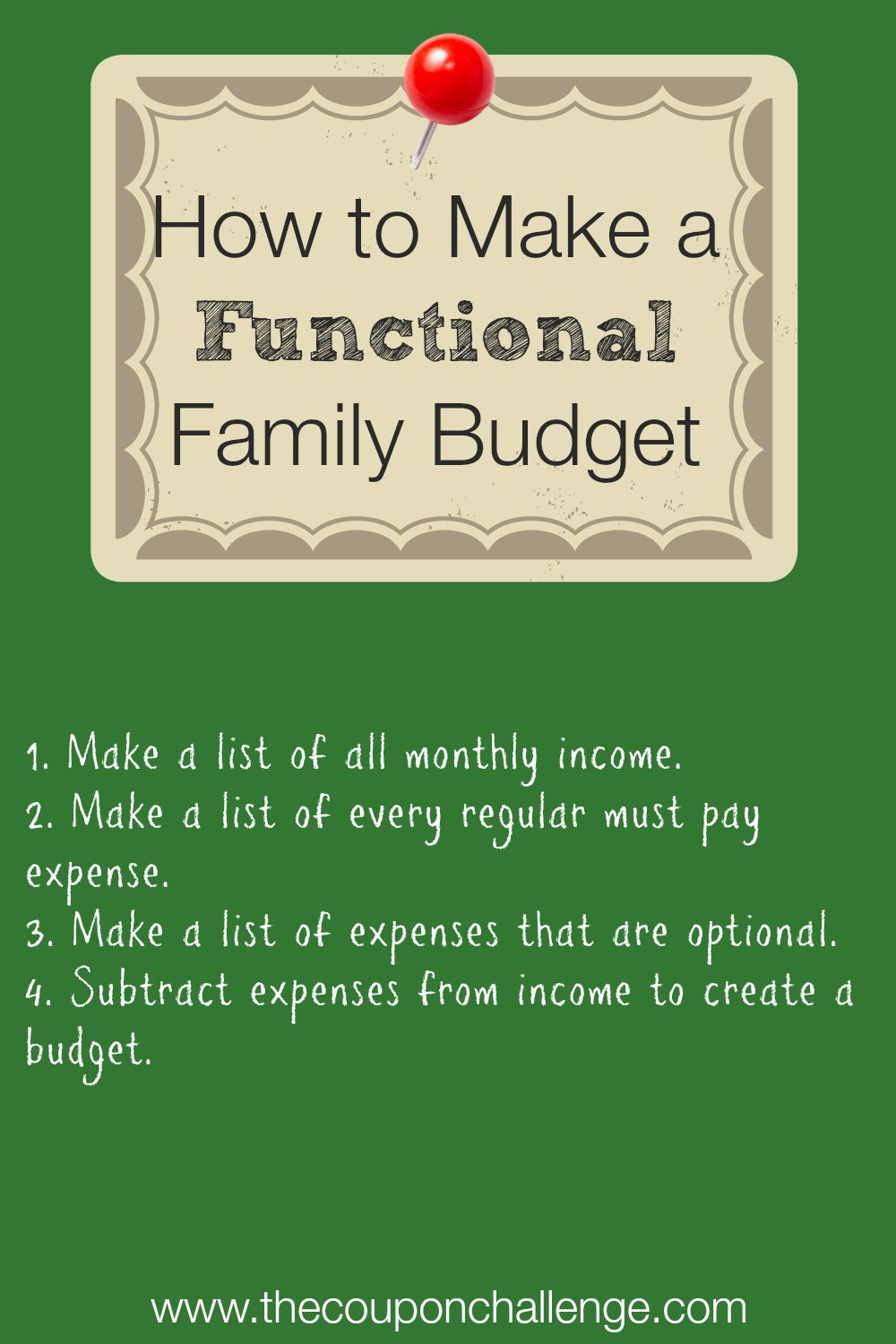

How to Make a Functional Family Budget:

1. Make a list of all monthly income. Make sure to include everything that regularly comes in. Child support, spousal support, employment paychecks, dividends from businesses and any self employment income. You want to have a good working knowledge of what you have to work with each month.

Type in a spreadsheet or document or write everything down in a notebook, so you remember to include items.

2. Make a list of every regular must pay expense. Include in this list things like your rent or mortgage, insurance, utilities and all of your minimum debt payments due each month. You should also include things like gas, food and routine education/childcare expenses for your children.

More details on must pay expenses:

- Mortgage or rent

- Insurance – home, auto, health, dental, vision, life

- Utilities – gas, water, electric, sewer/storm drain or propane for tanks

- All minimum debt payments from week 1

- Gas for car(s) – check past statements to get this number if necessary

- Food – I like to include all grocery food, personal care (such as shampoo), household (such as toilet paper and windex). Again check past statements to get this number if necessary.

- Education or child care for children

- Extra baby needs (such as diapers & wipes)

- Savings for emergency fund (see below)

- Other must pay expenses such as monthly out of pocket charges for allergy or asthma medications

3. Make a list of expenses that are optional. These would be things like eating out, entertainment, subscriptions, manicures, haircuts, and other items that are not monthly budget items that must be handled.

This list is going to be considered your wants list that may or may not be possible to add in right now. To make this list, you may want to look at your bank statement, credit cards statement(s) and receipts for the last month. Include any and all expenses that you find even if they aren’t considered needs. This will help you know what things have become money traps for you.

As you go through your past statements, total how much you spent at Starbucks, the amount you spent at restaurants, going to the movies or on new clothes. This will help you know where your money has been going and how you can take back control of it!

4. Subtract expenses from income to create a budget. Here is the hard part. You can start with a simple pen and paper, get complex with spreadsheets or use our free budget planner, but you have to come up with a functional budget.

Start by listing your total income, then list out each of your must pay expenses (remember that Starbucks is a want and shouldn’t be included here). Subtract the expenses from the income to see what is remaining.

This is where things get sticky sometimes.

If there is a lack of money to cover the must pay bills, then you have some real issues to repair. If there is a very small amount left, then it is time to evaluate what off your optional list can be covered, or where (ideally) that additional can be applied toward savings or debts.

Making a functional family budget isn’t about strict guidelines as much as it is about making sure you have the important needs covered, and you aren’t blowing the rest of your money on things that are unnecessary. As long as your needs are met, you are able to put some money aside for savings and you are able to pay toward your debts, then you can finally include those splurges.

For a financial situation where debts have taken over, it’s time to drop the splurges for awhile to focus on getting back in good financial shape. Don’t worry – this is only temporary!

Where do tithes/donations fit in? Well, that is a personal choice. Most people will tell you that a tithe should be in your must pay section and that is fine. If you have balanced your budget and are in a dire financial situation, you may want to hold off or reduce those donations temporarily. Pull yourself out of debt and use some of that snowball momentum to return your tithe to it’s previous amount – you may even be able to give more!

Save it First! You should really work to have a $1,000 emergency fund before you start paying off debt and adding in more wants from your optional list. Why? Because you don’t want to put yourself further into debt when something unexpected happens – and it WILL happen! You’re daughter breaks her glasses or your tire needs to be replaced. You want to be able to spend the money you already have instead of borrowing more.

This is why I have savings as a must pay item. If you already have $1000 emergency fund, awesome! You are ahead of the game here! If not, put $5 – $10 in that field for now and see how much money you have left after subtracting your “must pay” expenses from your income.

More Tips:

Review your budget often. You’ll likely spend the first several months tweaking your budget. However, once your budget is set it will no longer need constant supervision. Check your budget on the first of each month to determine if your expenses are still accurate or if there is a large purchase coming up that needs to be factored into the budget.

Be realistic with your budget. You won’t succeed if you set unrealistic goals. If you’re trying to cut spending, don’t take a $600 per month grocery bill and only allow yourself $200 per month. It won’t work and you’ll give up quickly.

Next week we will focus on making a debt repayment plan. Sounds fun, right? It will be – eventually. I promise.

Week 2 Challenge:

Set up another budget meeting with your spouse or significant other. Yep, it’s time to meet AGAIN. The possible shock of your debt from week 1 should have worn off & you’re now ready to tackle setting a budget. Follow through the steps above to determine your income vs expenses.

If you have money leftover after all your must pay expenses then you can add some optional expenses into your budget plan, but I would suggest cutting those out at least for this week to give you a little more cushion. Next week, we will talk more about paying off your debt which will be a priority over your optional/ want expenses.

The goal is to CUT YOUR DEBT, right?!

You might also like my old Blank Budget Form to use a a possible guide for establishing your budget

Disclosure: I am not a financial adviser nor do I have formal financial training. All articles are for informational purposes only and should not be interpreted as financial advice or consultation. Please consult your account and/or financial adviser before making changes to your finances. All situations are different, so please consult a professional to determine your individual needs.

Very helpful outline of creating a budget. Budgets can be such a great tool when getting out of debt.